Adding EU VAT number to WooCommerce checkout can be done easily. You’ll see how to check in WooCommerce if the EU VAT number is valid and automatically invoice with a plugin! Handle EU orders with the proper VAT (or without the tax). Get the EU VAT validation and invoice at the same time thanks to the Flexible PDF Invoices WooCommerce plugin. Let’s begin!

In this article, you will learn how to:

- Check EU VAT number & invoice in WooCommerce

- Add the EU VAT number field

- Validate the VAT number (with and without a plugin)

- Issue invoices in the EU with the proper VAT (OSS, reverse charge)

- Create invoices in WooCommerce automatically

Check EU VAT number and invoice in WooCommerce

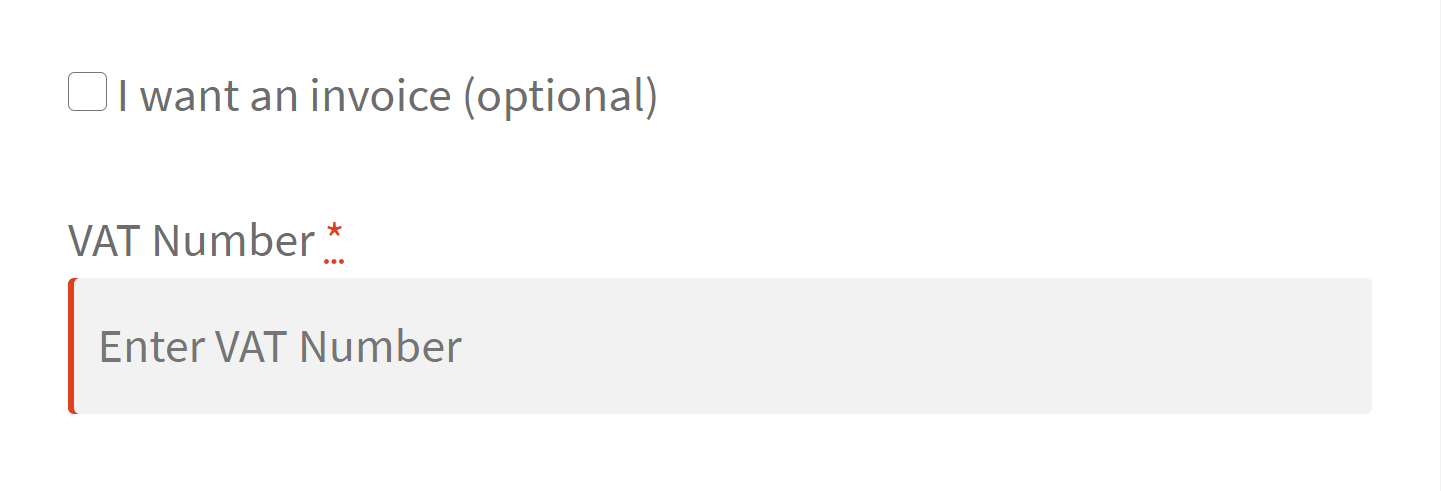

Use the plugin that gives you the whole package. First, get the EU VAT field in the WooCommerce checkout:

The plugin will add the right VAT for OSS orders and remove VAT if the customer provides a valid EU VAT number during checkout.

Read more about issuing invoices in the European Union using WooCommerce which allows different VAT, OSS, and reverse charge.

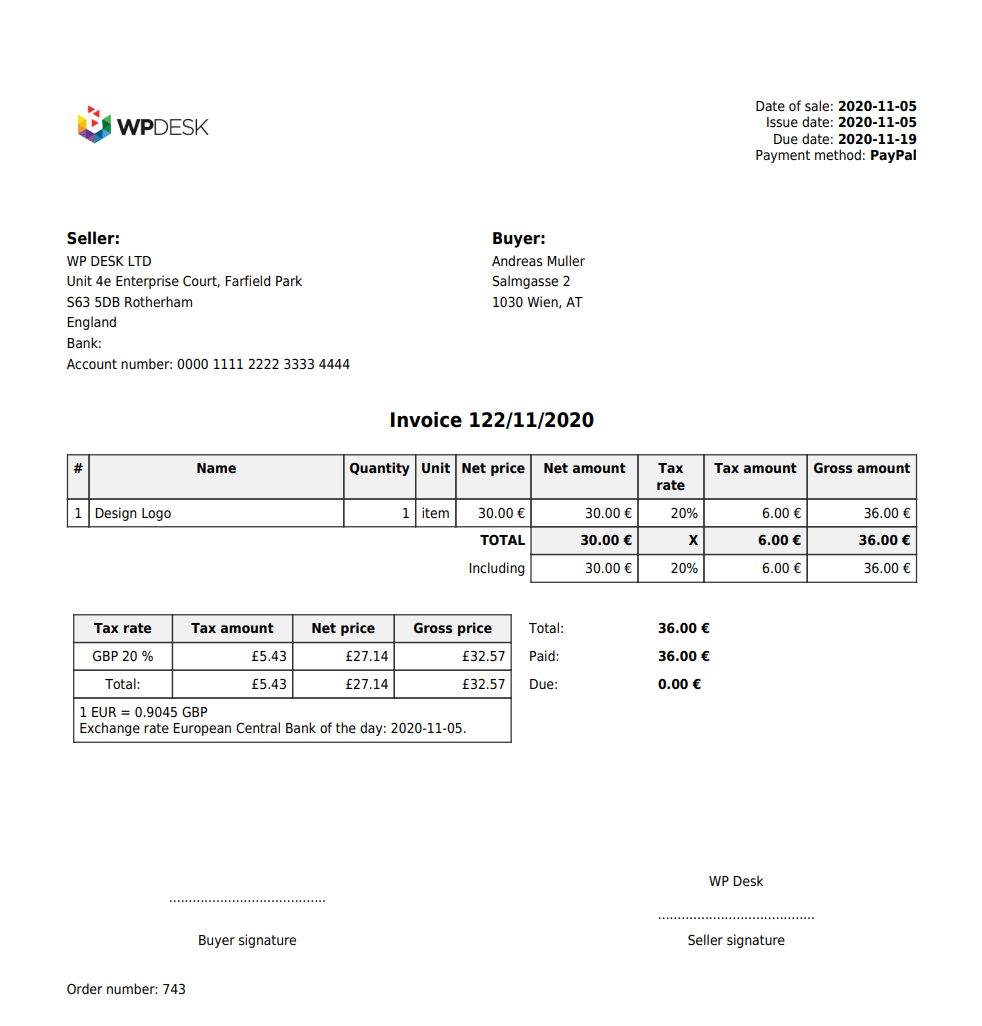

What’s more, Flexible Invoices will issue an invoice automatically:

If the order is in another currency there may also be a VAT conversion table on the invoice with rates automatically taken from the European Central Bank:

Read more about VAT conversion and creating currency invoices in WooCommerce. Check also the plugin’s documentation.

How to add the EU VAT number field to the checkout in WooCommerce?

There are a few ways to do that. You can use a plugin or add your own PHP code to the theme’s functions.php.

Read more on adding the VAT Number (EU VAT) field in WooCommerce (3 ways) 2 with plugins and 1 manual.

You may:

- Add new fields to the WooCommerce checkout form adding custom PHP code.

- Use a plugin to manage checkout fields in WooCommerce.

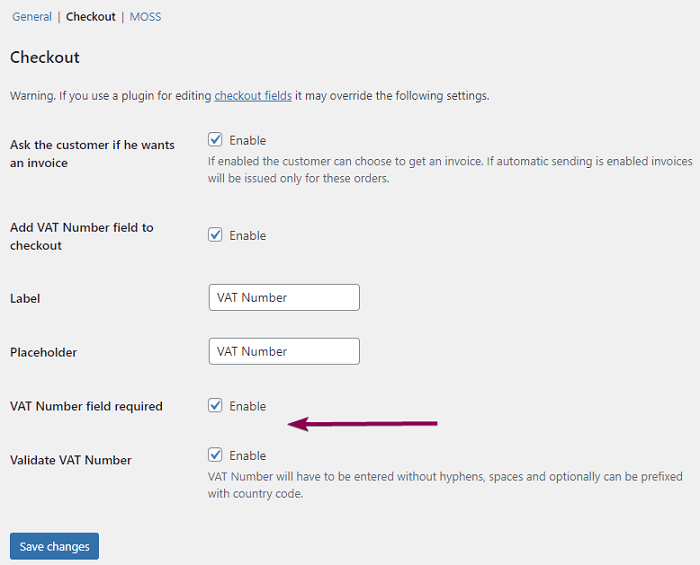

- Install Flexible PDF Invoices where you can simply enable such a field in the plugin settings.

Add the EU VAT Number field with the Flexible PDF Invoices free plugin

When and how to check the EU VAT number in WooCommerce (without and with a plugin)?

That part is quite easy. The validation will be needed if want to sell in the EU.

You have three options:

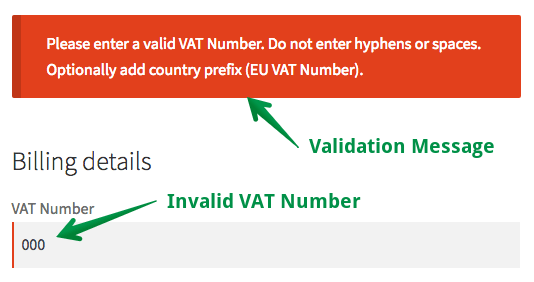

- Use a plugin to check if the VAT EU number is valid.

- You can do it manually with a VIES checker (or directly on the VIES VAT number validation page).

- Check the EU VAT number automatically with Flexible Invoices PRO.

There are a few plugins available that will help you to get the VAT of the customer or even remove the VAT from the order when the VAT EU number is validated. Flexible Invoices PRO has all these features.

So, you get validation of VAT EU numbers, automatic OSS/reverse charge, handling the VAT for orders properly, and invoicing in WooCommerce with one plugin!

Read more on Flexible Invoices and why it’s the best WooCommerce invoice plugin.

Automatic validation of the EU VAT for OSS

If you sell digital goods you will need to check if your customers are individuals or businesses. According to EU law, you need to add the proper country tax rate based on the client’s country of consumption.

On the other hand, when selling for business customers the order should receive the reverse charge annotation and no VAT. The EU introduced in 2015 the MOSS that allows managing VAT and European transactions without the need to register for VAT purposes in every member state.

See also the complete tutorial on how to set WooCommerce tax rates & how to set up VAT tax rates in WooCommerce for EU invoices.

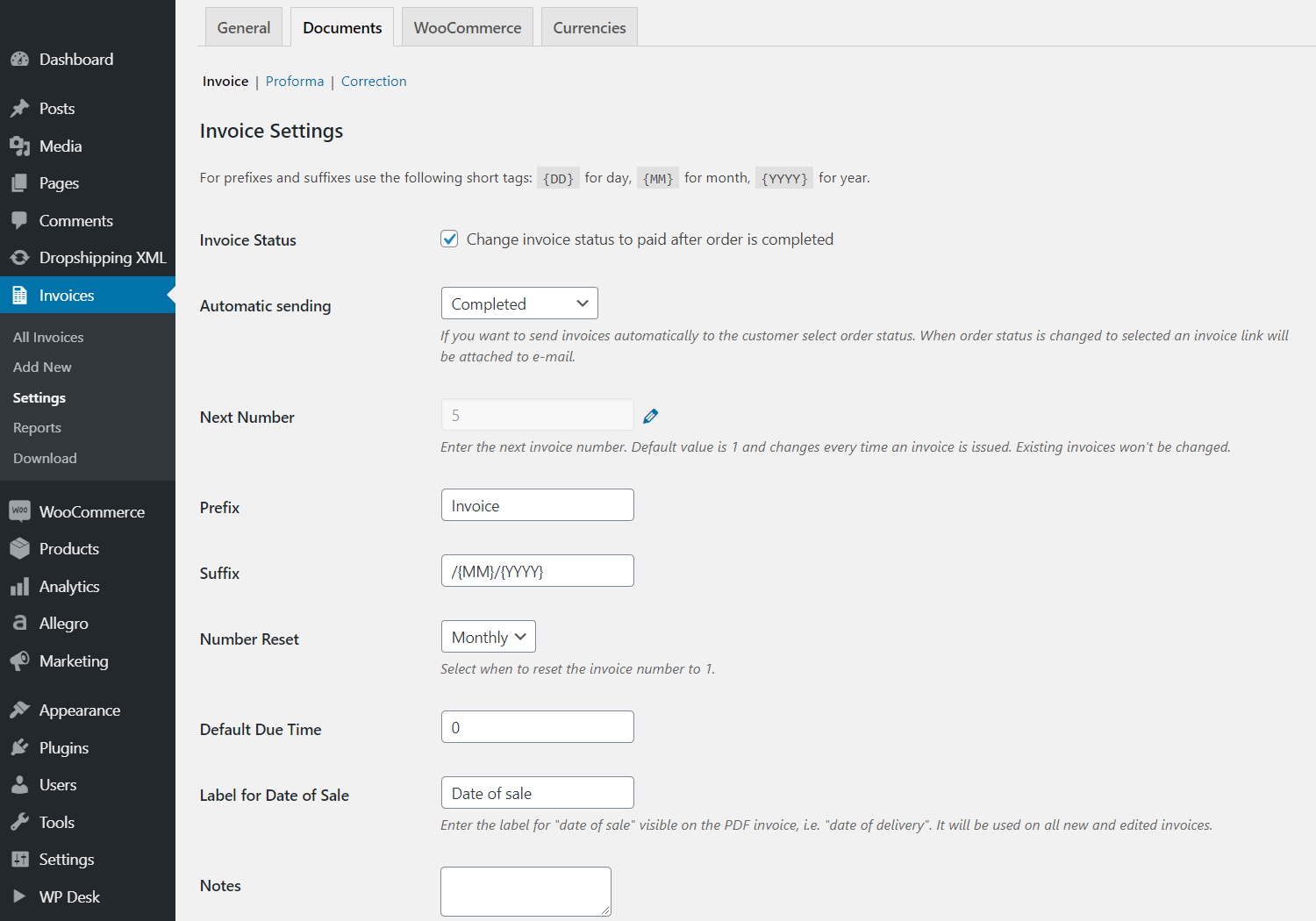

How to invoice automatically for WooCommerce orders?

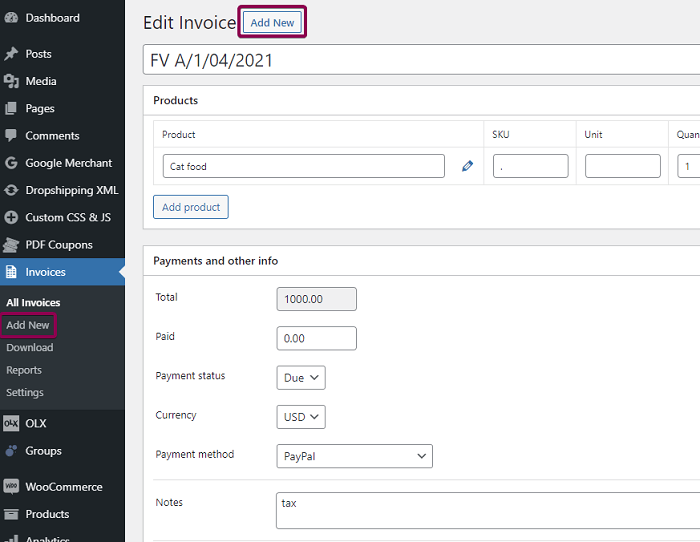

When the order is paid (in most cases by an online payment gateway), it is ready for the next phase – delivery and invoicing. The Flexible Invoices plugin lets you turn on automatic invoicing and document sending based on the order statuses.

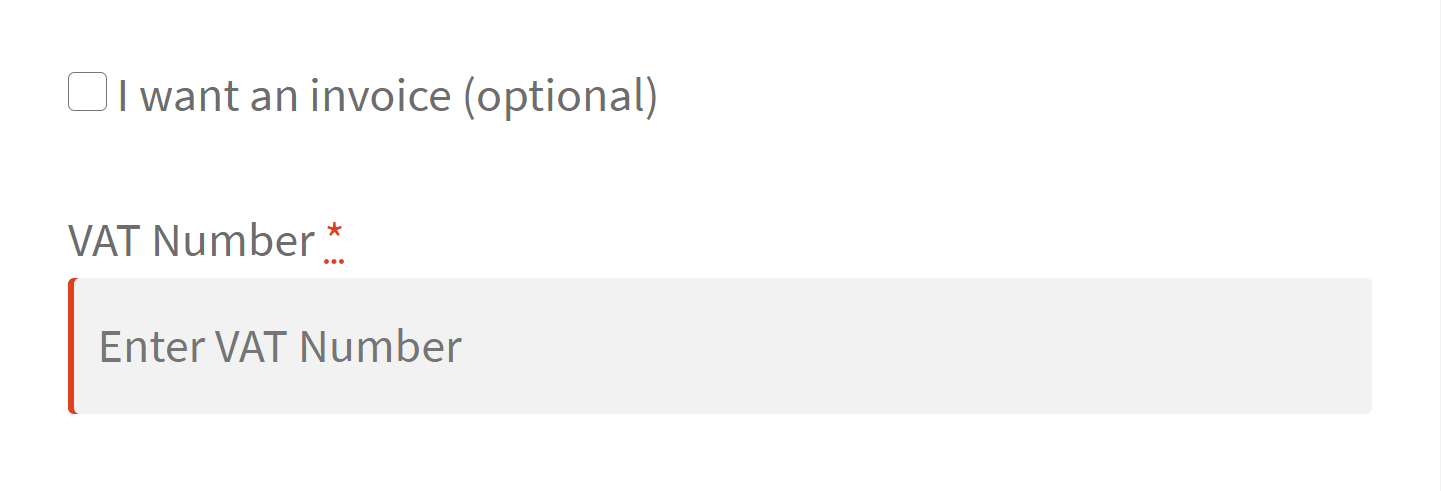

You may also ask your customers if they want an invoice during checkout.

Of course, you can use Flexible Invoices to generate PDF invoices for customers from the entire World. The plugin will let you issue manual invoices as well!

And the plugin validates EU VAT numbers and invoice with the proper VAT rate for EU customers automatically for you.

Check if the EU VAT number is valid and invoice in WooCommerce automatically!

Visit the Flexible Invoices page to see all its features and types of documents you can use with the plugin. Receive the tool to invoice for all clients including EU customers according to EU law.

Thanks to the built-in EU VAT number field and its validation it will be easier and much faster!

New Ideas & Demo

Let us know if you have questions/ suggestions. We are open to suggestions about possible improvements and ideas for the plugin.

I encourage you to test the plugin (free, PRO, add-ons) in your free demo. You may also start using the free version of the plugin right away.

How about WooCommerce Invoice System, facture WooCommerce, faktury WooCommerce, e-boekhouden WooCommerce in one plugin

Of course! You may use the plugin in English, French, Spanish, Italian, Polish & Dutch. Use it as your WooCommerce Invoice System (or e-boekhouden WooCommerce) and to issue WooCommerce fakturas (or facture WooCommerce or faktury WooCommerce) in your store automatically as well. The plugin supports WPML.

Also, see the longer article to see how to create, download, email & print an invoice in WordPress & WooCommerce.