Do you want to know how to issue an EU (OSS or a reverse charge) invoice in the European Union using WooCommerce? In this article, you can find a way to issue OSS and reverse charge invoices in WooCommerce.

- About an EU Invoice in WooCommerce

- How to create a VAT EU invoice in WooCommerce

- Reverse charge invoice example in WooCommerce

- Issue OSS invoices for WooCommerce – Plugin & Demo

About requirements for invoices in the EU

If you sell digital products to customers from European Union countries, then you are certainly concerned with the issue an invoice in WooCommerce with the correct VAT rates for such EU transactions. In the case of the sale of telecommunications services, broadcasting services, and electronic services to non-VAT payers, the value-added tax should be settled in the Member State in which the consumer who is a consumer is generally resident.

You can read more about the OSS issue on the page of the European Commission.

Thanks to the OSS system, invoices have different VAT rates according to the client’s country of residence. Now, you can issue an invoice for clients from the European Union using WooCommerce and Flexible Invoices for WooCommerce plugin.

So, how to issue an invoice in the European Union using WooCommerce?

You can do it with the Flexible Invoices for WooCommerce plugin. Recently, I have written about new functionalities added to the plugin that allows comfortable invoicing for European Union customers. What is more, I have also mentioned that Flexible Invoices for WooCommerce are following the EU law!.

Plugin Settings

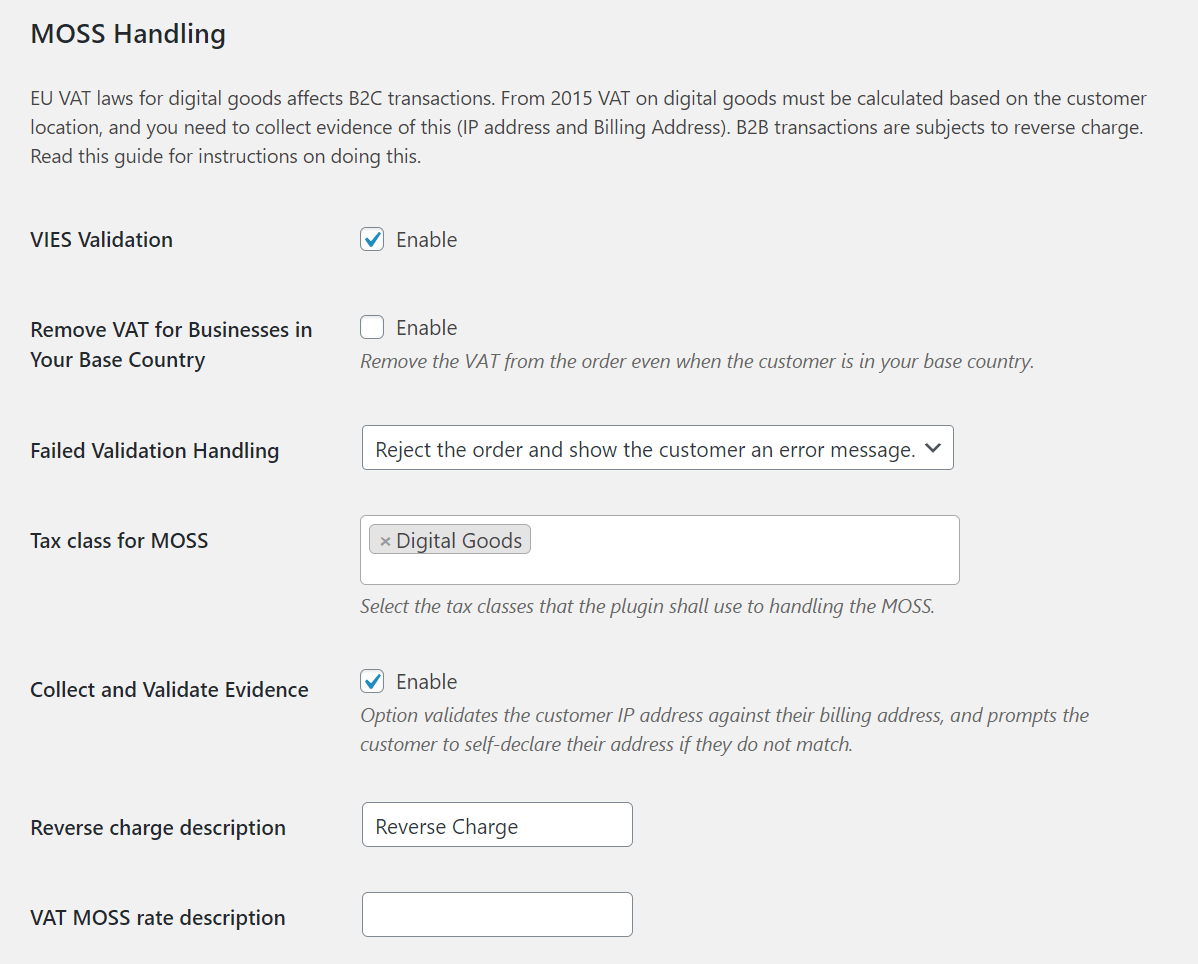

I would like to show you these plugin settings now that will allow you to issue invoices in the European Union in WooCommerce with the correct VAT tax rate.

The plugin will allow you to choose the rate (or rates) that are then used to handle OSS transactions.

-

Set the EU tax rates

First, set the appropriate tax rates for individual European countries. Our how-to configure WooCommerce taxes complete tutorial can help you with that task.

-

Enable EU VAT Number validation

Then, you can additionally enable validation of the client’s EU VAT number in the VIES database. For a business customer, the reverse charge procedure should be used. VAT settlement will be the buyer’s responsibility. If the EU VAT number validation fails, you can specify whether the order will be accepted and VAT will appear on the invoice or not.

With Flexible Invoices PRO, you may check the EU VAT Number and invoice with one plugin!

-

VAT for individual customers (OSS invoices)

However, for individual customers, you can make sure that VAT is settled for the country they declare. It may happen that the customer’s payment address and IP address do not point to the same country. In this case, you can allow the customer to declare (confirm) the address on the checkout page.

-

Reverse charge invoice (B2B orders)

Finally, the last options will allow you to specify a description for the reverse charge invoice for B2B orders in WooCommerce. Set also the description for the VAT rate that you will be using on OSS (MOSS) invoicing.

OSS invoices

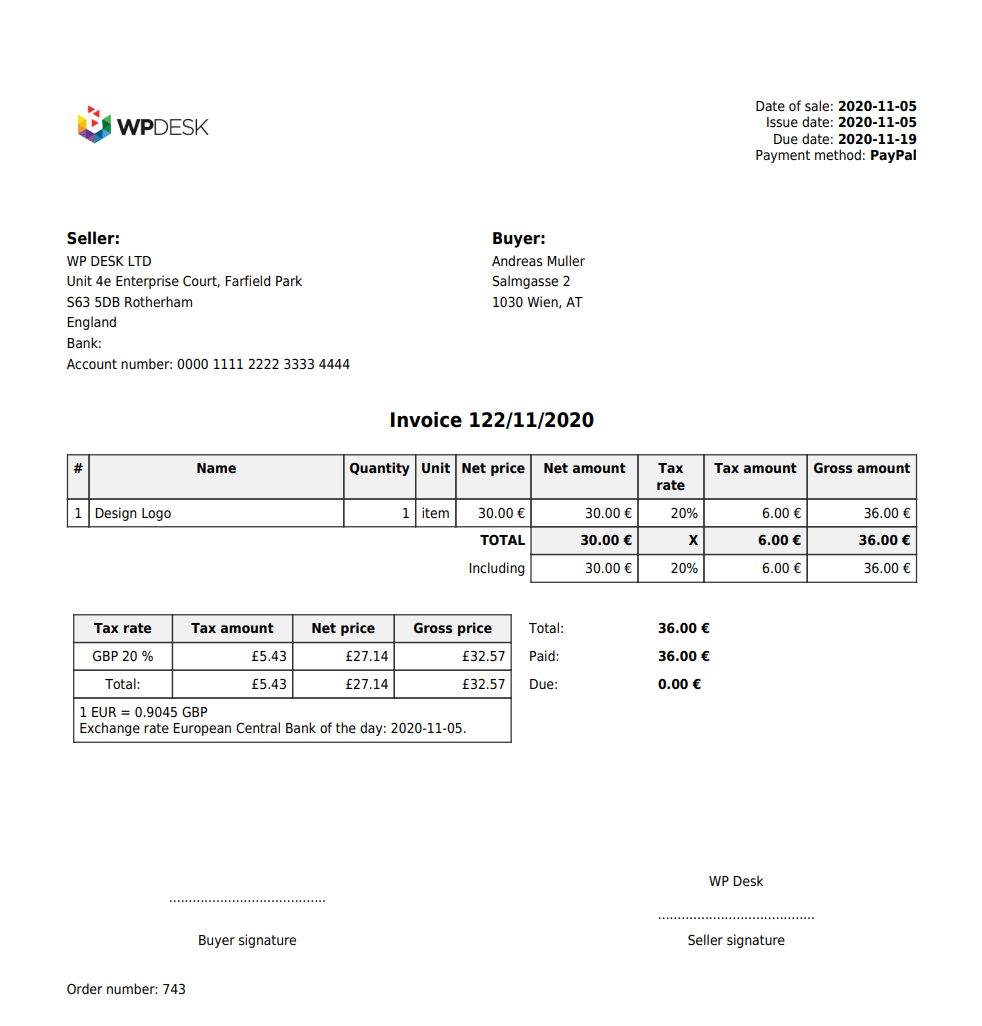

An OSS invoice for an individual customer may look like this:

Thanks to the Flexible Invoices for WooCommerce plugin, a document may also contain a conversion table with rates automatically taken from the European Central Bank. More about this issue in the next post.

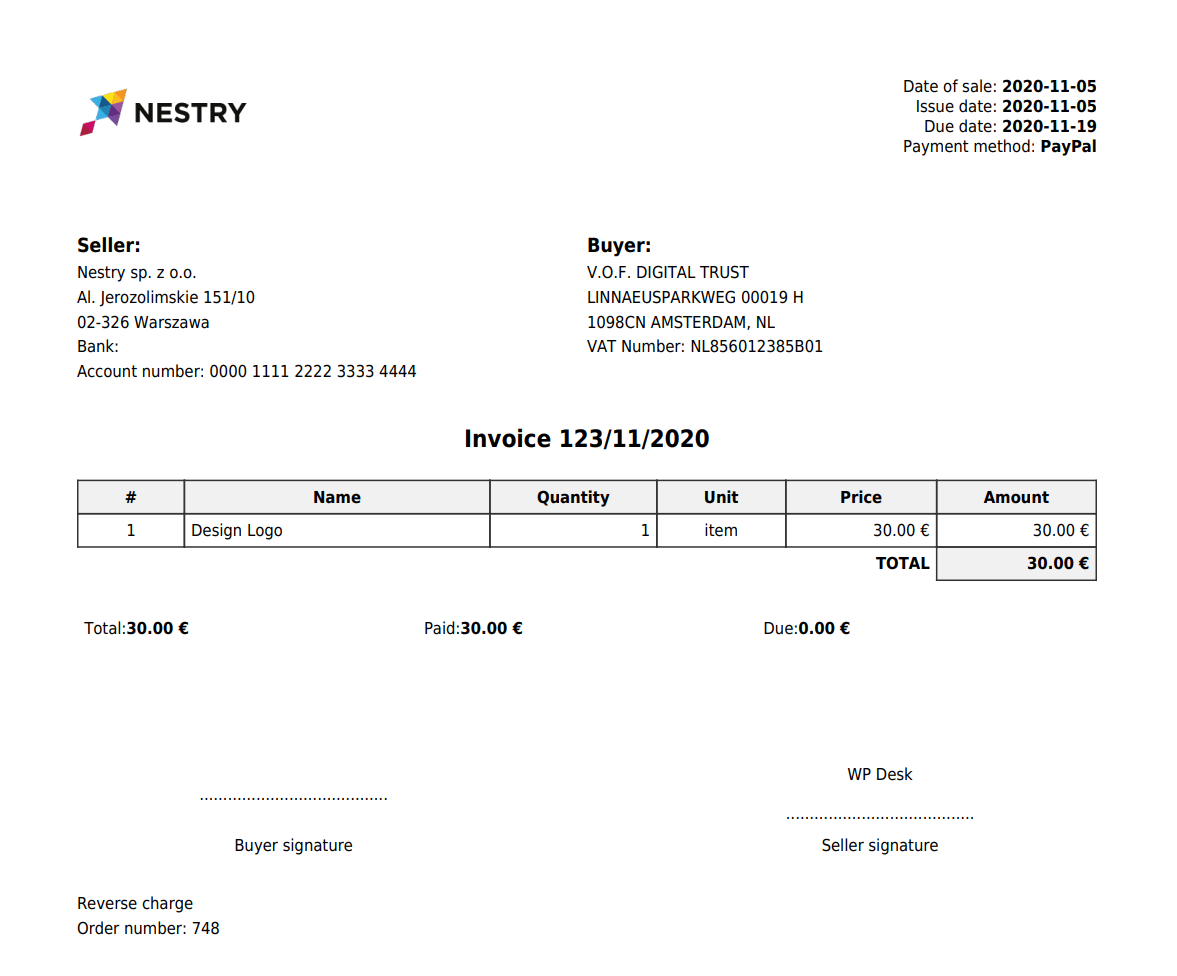

Reverse charge invoice example in WooCommerce

However, if the customer is a VAT payer, you cannot use the OSS/ VAT procedure. You issue an invoice without VAT along with the appropriate description according to the reverse charge procedure. Such an invoice could then look like this:

Now you can issue OSS invoices for WooCommerce

I hope you already know how to correctly issue invoices in the European Union using WooCommerce. Flexible Invoices for WooCommerce plugin allows you to handle OSS transactions and issue invoices for orders from customers in all EU countries. Let us know if you have further questions.

Also, if you want to know more, I encourage you to read:

- How to create, download, email & print an invoice in WordPress & WooCommerce with a plugin

- How to set up tax rates in WooCommerce for EU invoices

- WPML Support (the plugin is currently translated into English, French, Spanish, Italian, Polish & Dutch)