E-commerce sales to EU countries so far depended on the type of products sold. Virtual products were covered by the MOSS called procedure, under which the store customer, a company from outside your country, did not have to pay VAT tax. From July, classic products will also be included in the new OSS procedure. Find out how to set the tax rates and create OSS invoices in WooCommerce.

In this article you will learn:

- What is OSS

- How to Set Tax rates for OSS in WooCommerce

- How to enable the OSS mechanism and invoice in WooCommerce

- About VAT EU Number validation in the VIES database

What is OSS?

OSS stands for a One Stop Shop, which is a procedure to settle VAT tax on sales in the European Union. It extended the previous MOSS (Mini One Stop Shop). Who will be affected by the new procedure? All stores, whose goods are purchased by both individual customers and companies. Their orders must be placed outside your country, but from within the EU.

In addition to virtual products, also mail order products

Sales to business customers will be almost the same as before, but in addition to virtual products, telecommunications, digital services, it will also include shipping products. When placing an order, the customer will enter the EU VAT number, which will be verified in the VIES number database.

Positive verification will automatically reset the VAT rate for the customer to zero. This is how it used to work under the MOSS, and this is how it will work from July under the OSS.

Are individual customers also covered by this procedure after 1 July 2021?

Yes. Currently, The situation is slightly different for individual customers. Here, VAT is not levied, but the tax rate is changed to the EU country from which the order is placed. The change of the tax rate depends on the volume of sales. The limit is 10,000 euros.

If the e-commerce store does not exceed the limit, the individual customer will pay the VAT rates applicable in your country. If the store owner knows that the limit will be exceeded, he should register for VAT OSS.

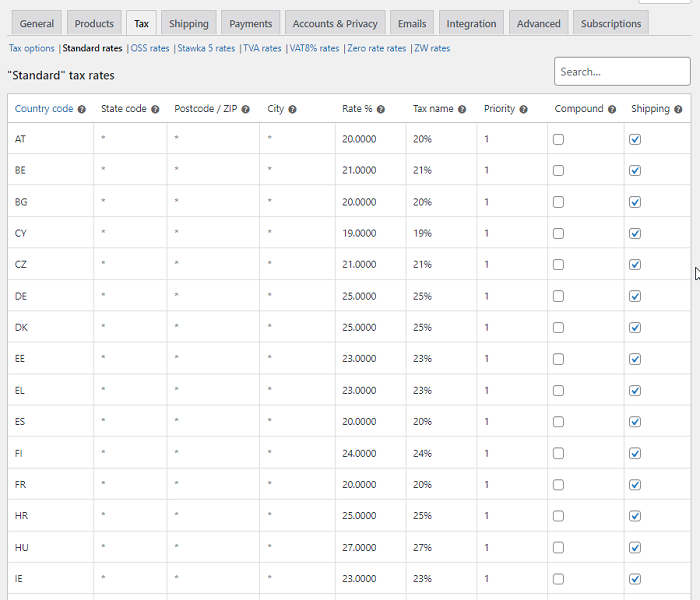

Tax rates for OSS in WooCommerce

Set the tax rates

First, you need to set the tax rates for EU countries in your store.

Read more about setting WooCommerce taxes & download the standard EU VAT tax rates in WooCommerce.

The taxes depend on the country

Ok. You’ve set the tax rates in WooCommerce. From now on, the tax rates for the products will be calculated according to the applicable VAT rates of the EU country from which the order was placed. This does not mean that from now on you will settle accounts with the tax authorities of other EU countries.

It will still be your country office and the declaration will be submitted in your language.

How to enable the OSS mechanism and invoice in WooCommerce?

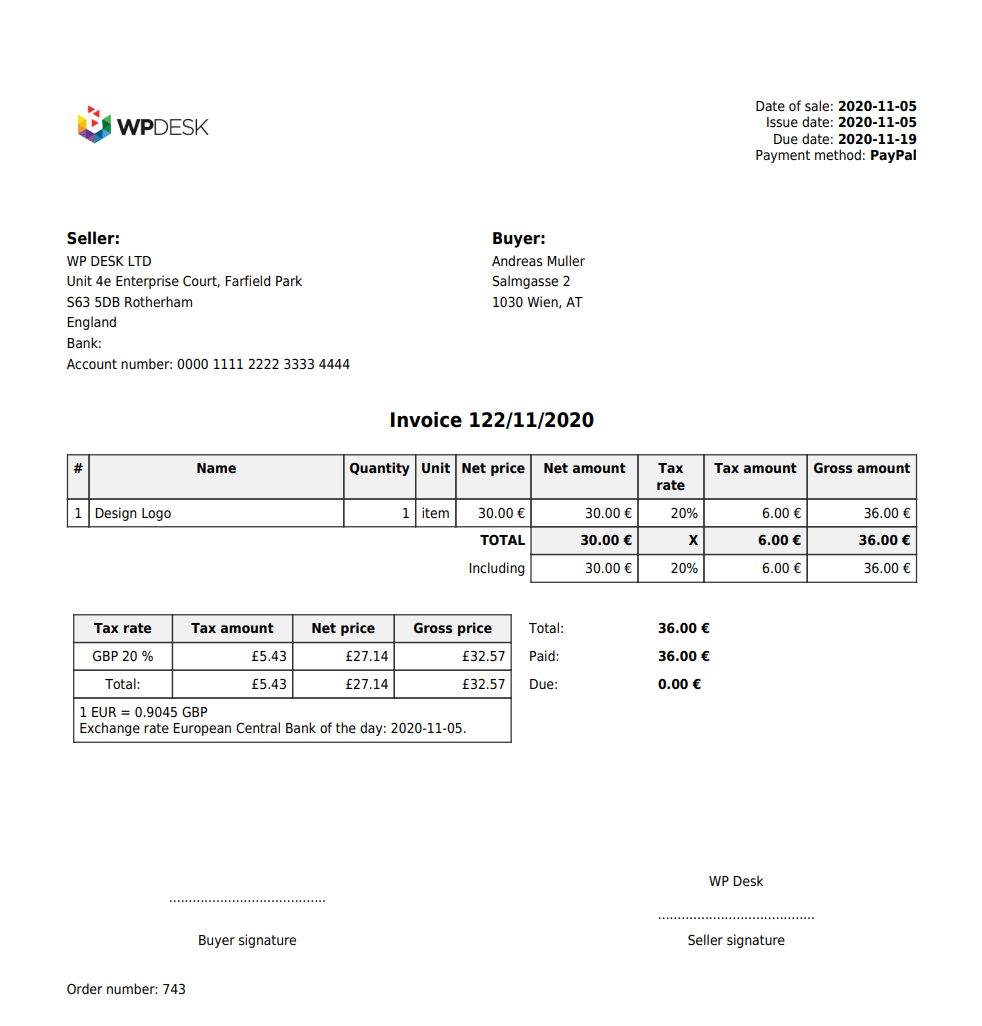

So much for the legal basics of the issue. Let’s assume that you will use the OSS procedure in WooCommerce. How then to issue this type of invoices, with the help of our accounting plugins?

You may use the Flexible Invoices for WooCommerce plugin to create OSS invoices in your store.

All you need to do is enable OSS in WooCommerce in the plugin.

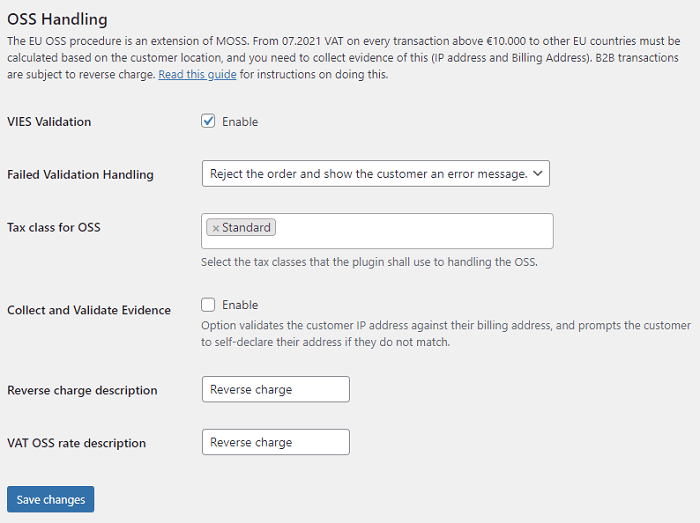

To do that, first go to Invoices > Settings > WooCommerce > OSS.

Now, choose the WooCommerce tax rate for the OSS invoices & EU VAT Number Validation.

Don’t forget about the OSS tax class

For the plugin to fully function in OSS mode, you need to set the tax class. If you need more info, check here how to set tax classes.

You can also enable the allow address declarations option. This option validates the customer’s IP address against their billing address and prompts the customer to self-declare their address if they do not match.

Verify business customers through the VIES database

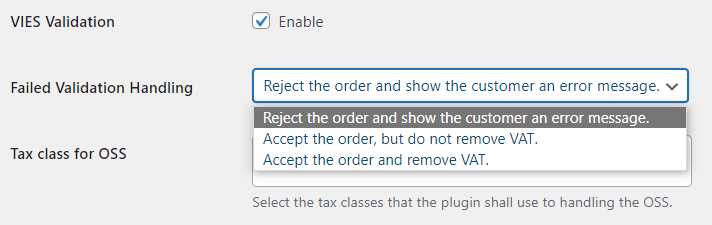

If you are already in the OSS panel, go to the plugin settings in OSS Handling and enable the Validation of VAT EU Numbers in the VIES database option. By doing so, you will make sure that every time a business customer place an order, the plugin will check the EU VAT number through the VIES database.

Now, what it means is that an EU business customer that passes the verification of its number will be able to count on VAT reduction when buying both digital and normal products that require shipping.

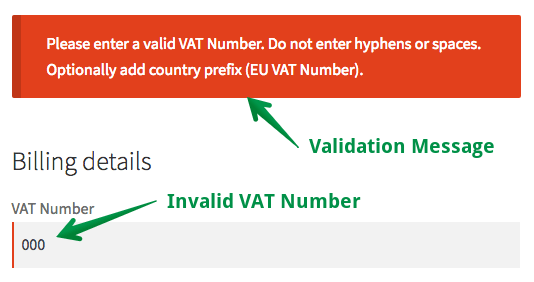

How will the plugin behave if the number validation fails? The order will not be placed, and an error message will appear on the site. However, there are other options to choose from.

As you can see, here you can set up three plugin options in case the VAT number is not successfully validated in the VIES database. These are:

- reject the order and show the customer an error message.

- accept the order, but do not remove VAT,

- accept the order and remove VAT.

Of course, most store owners will choose the first option. However, there may be situations where it is necessary to set one of the other two options.

Final words

Visit the Flexible Invoices product page, check the free & PRO version of the plugin (plus its add-ons) in our free demo.

Also, read more on how to create a WooCommerce invoice in your WooCommerce with the plugin. And to issue & download the invoice in WooCommerce Quick Guide.