In this post, you’ll learn how to set up VAT tax rates in WooCommerce to invoice with a reverse-charge note when needed.

If you run your store in the European Union, you probably already know that you should sell your products at different VAT tax rates – depending on the country you’re selling to and whether your customer is a company or a person.

Fortunately, this is not as complicated as it looks at first. Below you’ll find a tutorial on how to handle the WooCommerce setup that will help you apply the correct VAT tax rates for each order. 🙂

VAT tax rates in WooCommerce for orders from the EU

WooCommerce itself is a magical software that allows you to really do a lot!

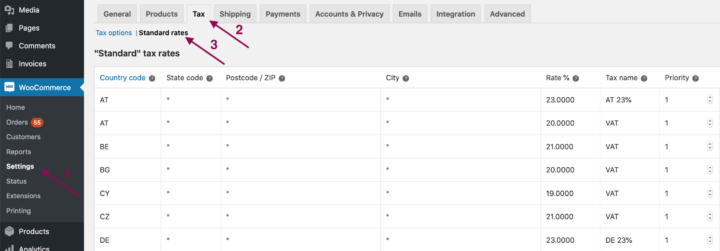

One of its built-in options is to manage tax rates in WooCommerce depending on the countries you sell to. To do this, use WooCommerce tax settings. Which you’d find in WooCommerce → Settings → Tax.

Then, create a tax class with specific rates for each country from the European Union. I used the “Standard” class for this:

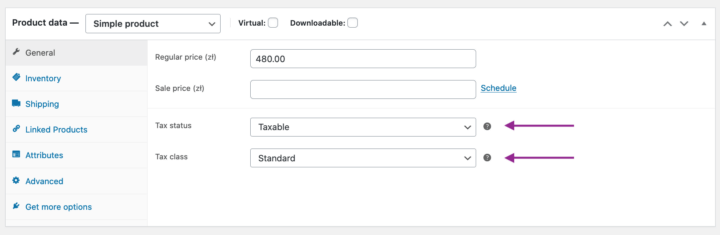

The last step is to set the correct tax class in WooCommerce products. Go to your product edit settings in Products → Product Name and check the tax rate setting in WooCommerce Tabs:

Awesome! 🎉 Now you are ready to sell products if your EU customers are not companies!

Note, that you can import VAT tax rates from a CSV file, so you don’t have to type them in manually. Import VAT tax rates from the CSV file.

You may read more on setting WooCommerce taxes in the How to Configure WooCommerce Taxes Complete Tutorial.

VAT tax rates in WooComerce for EU company orders

If you also sell your products to companies from different EU countries, you should know, that the business clients from other EU countries have to settle the VAT for products ordered in your store. This is crucial also for you because if a company from another EU country purchases in your store, the order shouldn’t have VAT added to the price of the products.

WooCommerce doesn’t have a built-in tool to help to deal with this process. But there are plugins on the market Like Flexible PDF Invoices PRO to help handle this requirement.

The plugin is compatible with EU law. Read more on how to create, download, email & print a PDF invoice in WooCommerce (and WordPress) with the plugin.

The plugin is currently translated into English, French, Spanish, Italian, Polish, and Dutch & supports WPML!

How to set up the reverse charge invoice in WooCommerce?

Adding a Reverse charge note on the invoice is a piece of cake with Flexible Invoices PRO.

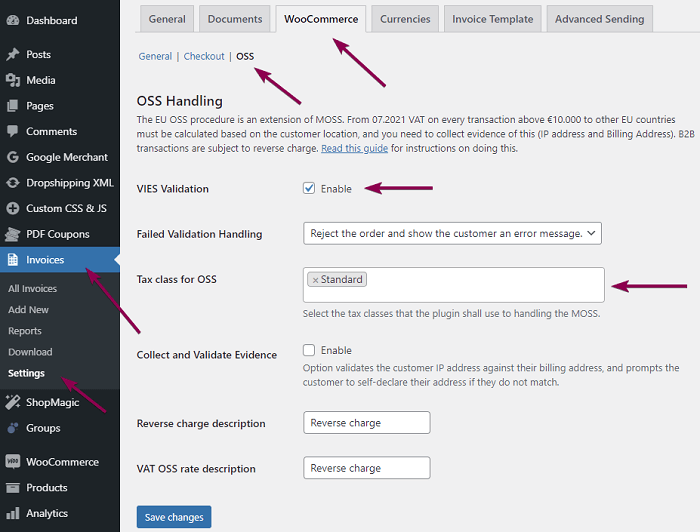

After installing and activating the plugin, go to Invoices → Settings → WooCommerce → OSS, where you should see this screen:

Here you will find the options you need to set up to automate order placing in the OSS, former MOSS standard:

VIES validation – this is an option that must be enabled. With it, the plugin connects to the VIES database and checks if the VAT number of your business client is valid.

Failed Validation Handling – decide what the plugin should do when your business client’s VAT number is invalid. The plugin can block such an order and communicate it to the customer. It can also accept the order but not exclude VAT from the price, or it can accept the order and remove VAT from the products’ prices.

Tax Class for OSS – set up the tax class that the plugin should use for orders from EU countries. This should be the same class that you selected in the product settings and tax rates WooCommerce settings.

Read more on how to set taxes for OSS in WooCommerce.

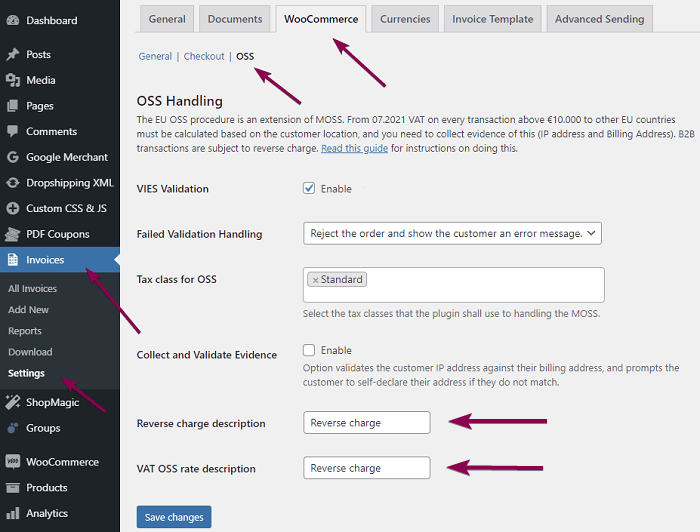

Reverse charge on the invoice

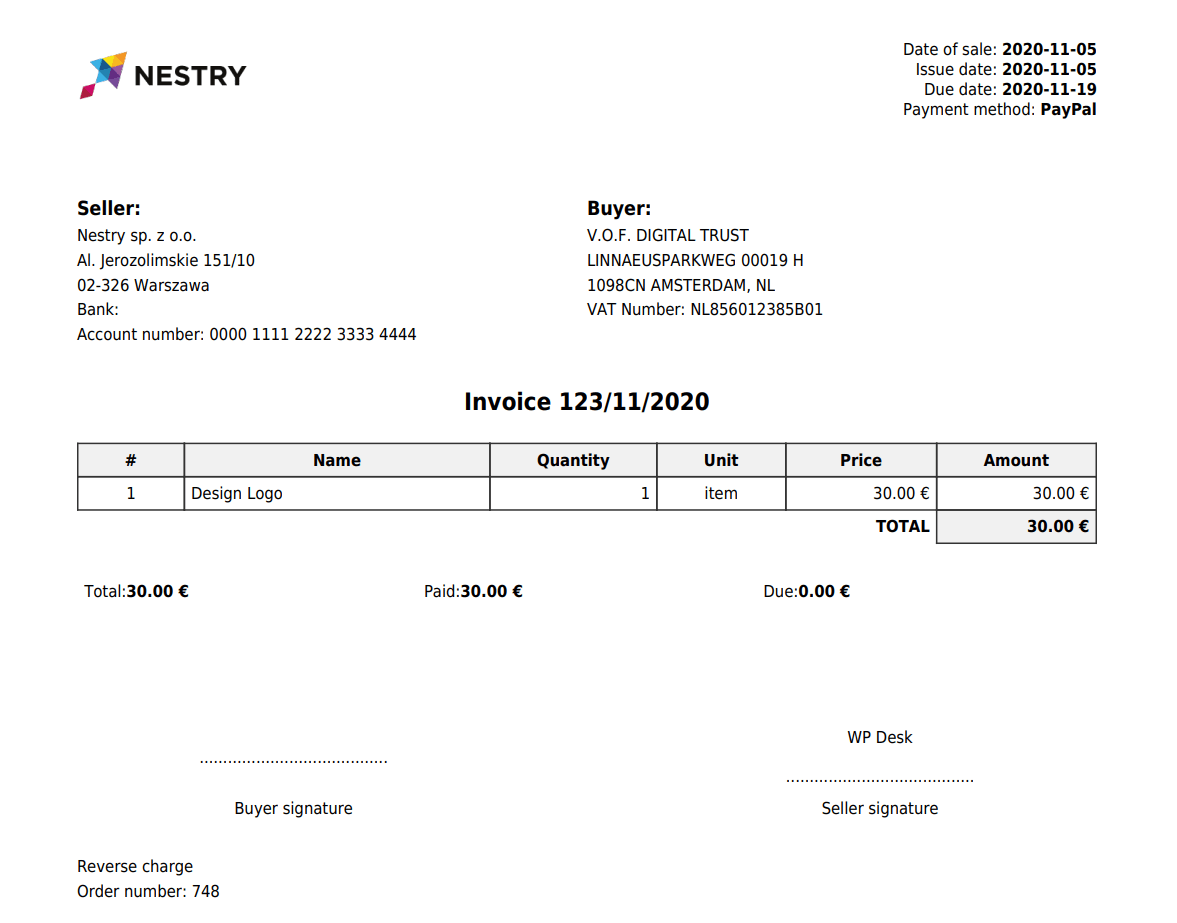

From now on, on every invoice issued in your store to a company from another EU, a note Reverse charge will appear.

That’s it! 🤓

Thanks for making it all the way here, I am taking it as a great reward for the effort I put into this text!

If you are interested in implementing the above solutions in your WooCommerce store, please check such settings in your free demo, and buy our plugin, or visit its page and let us know what you think about it.