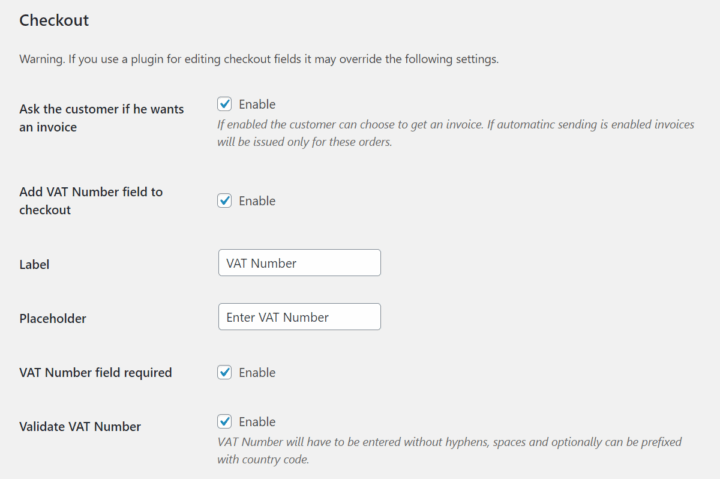

In the Invoices menu, select Settings and then go to the WooCommerce tab, Checkout section.

Ask the customer if he wants an invoice#

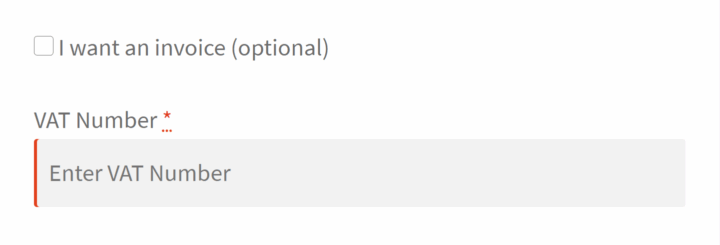

Enable this option if you want to give the customer a choice of whether they want to receive an invoice or not. If this option is selected in the checkout, a checkbox will be displayed. If the customer selects the checkbox, it will be possible to enter the VAT Number. Information about the client's choice will appear when editing the order.

If you enabled the option of sending the invoices automatically, they will be attached only to the orders chosen by the client.

Add VAT Number field to the checkout#

Enable/disable the VAT ID field in the checkout.

If you are using the plugin to edit checkout fields, i.e. our own Flexible Checkout Fields, it may overwrite the settings below.

The plugin adds a VAT ID field to the order form, it also gives a unique ID billing_vat_number for this field. You can use this functionality in combination with our other plugin Flexible Checkout Fields PRO if you want a customized order form according to the customer type. This is because the VAT ID field can appear in the order when the customer checks I want an invoice checkbox.

Label, placeholder#

Enter the label and placeholder for the field.

VAT Number field required#

Select to require the VAT ID field in order to place an order.

Validate VAT Number#

If this option is selected, the VAT ID field will be validated (no dashes, no spaces, and – optionally – with the prefix of the EU country).

VAT Number is validated for the following European countries: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom.

If the customer enters a country other than above the VAT Number will not be validated and considered correct.

If the shop's base country is in the European Union and the customer chooses an EU country (but other than the shop's base), according to the EU rules, VAT Number has to include a country prefix to be valid.