Having an invoicing system is one of these things you don’t want to think about every day. You just need everything to work well. Flexible Invoices for WooCommerce is a plugin that meets the EU VAT Compliance (OSS, vat exemption, VAT EU validation, currency exchange table, automatic rates from the ECB). So, you may generate invoices in WooCommerce for EU customers as well!

Invoices in WooCommerce for EU clients – In brief

The Flexible Invoices for WooCommerce plugin for invoicing with EU VAT assistant.

Now you can easily issue invoices for customers from the European Union countries! The plugin offers a comprehensive solution ready for quick use out of the box.

So, you do not need to install other paid plugins such as EU VAT Number. Because you get EU VAT Compliance for WooCommerce and invoicing in one plugin!

WooCommerce EU VAT compliance and features of Flexible Invoices

Here are the main functionalities you can find and use in Flexible Invoices for WooCommerce:

- OSS Handling (formerly MOSS)

- Reverse charge description on invoices

- Currency exchange table

- Exchange rates from the European Central Bank

- VAT number validation in the VIES database

- Translations and WPML Support

Accounting in the EU

From the company’s point of view, acting within the European Union requires the knowledge of a series of conditions. It is no different in the case of invoicing and documenting transactions with contractors from the European Union.

A valid invoice is very important for each side of the transaction.

One of the most important issues, when selling products and providing services abroad, is determining the country where VAT should be settled.

It’s about calculating tax amounts correctly, showing VAT rates on an invoice, and placing additional specific data on invoices.

This is a part of the WooCommerce VAT OSS (MOSS) invoice requirements. You can read about it below.

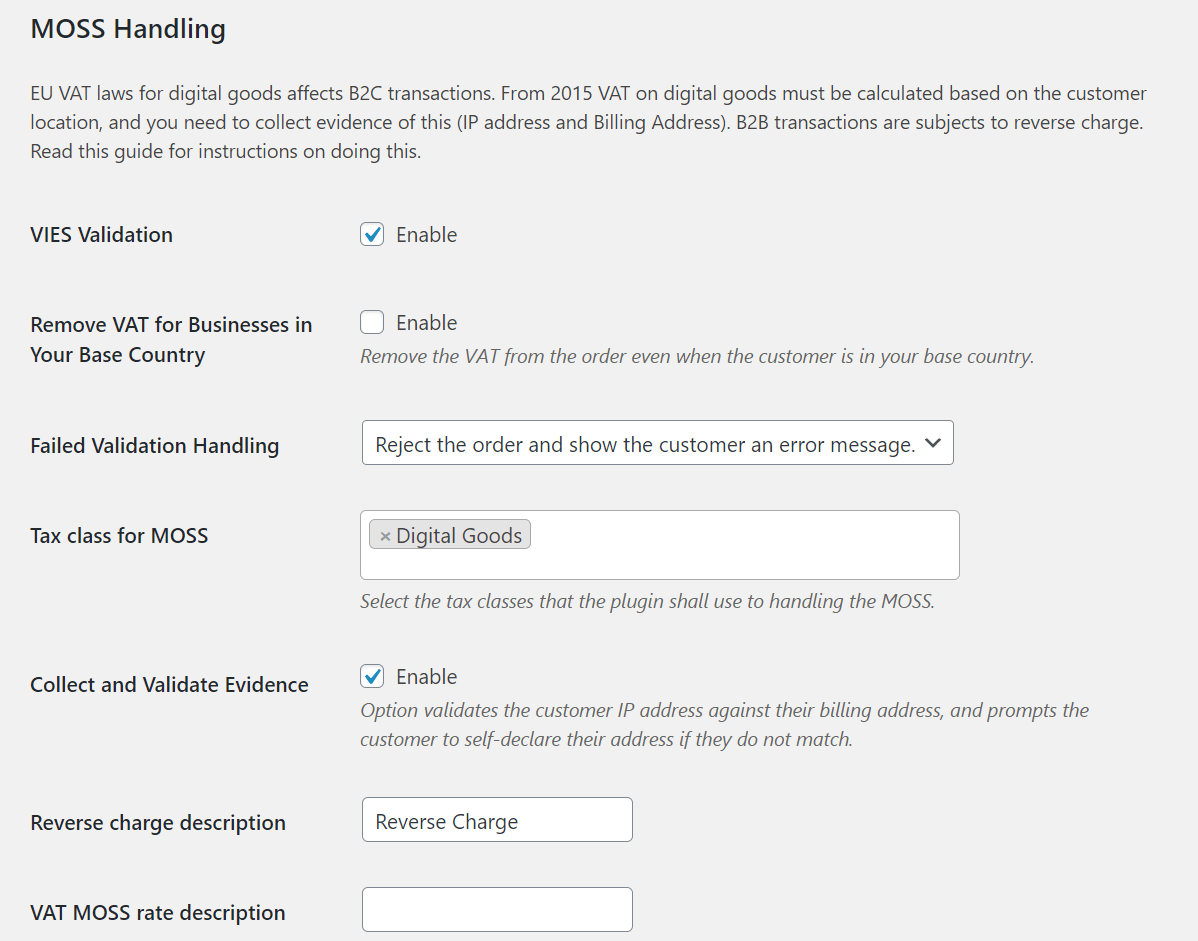

OSS handling (formerly MOSS)

Since 2015, VAT on digital goods (and other telecommunication, broadcasting, or electronic services) is usually charged in the country of which the customer is a resident (who is not a VAT taxpayer).

Sometimes when placing an order, the address provided by the customer is different from one that is suggested by the customer’s current IP address location.

Therefore, you can additionally allow the customer to confirm his/her address to apply and add the proper VAT tax rate for that given country. Handling taxes correctly is one ingredient for WooCommerce EU VAT compliance.

WooCommerce Tax Rates & current OSS mechanism

Our plugin will allow you to issue invoices with the appropriate VAT rate based on the customer’s country.

First, you need to configure tax rates in WooCommerce, of course. You may read more about this in the How to configure WooCommerce Taxes Complete Tutorial.

However, if we apply the OSS invoice requirements & rules and the foreign company is obliged to settle the tax, then the invoice does not specify the tax amount or its rate.

The most common solution, in that case, is to include an annotation to an invoice – i.e. not taxable.

There should also be information about the reverse charge procedure placed on an invoice for such an order.

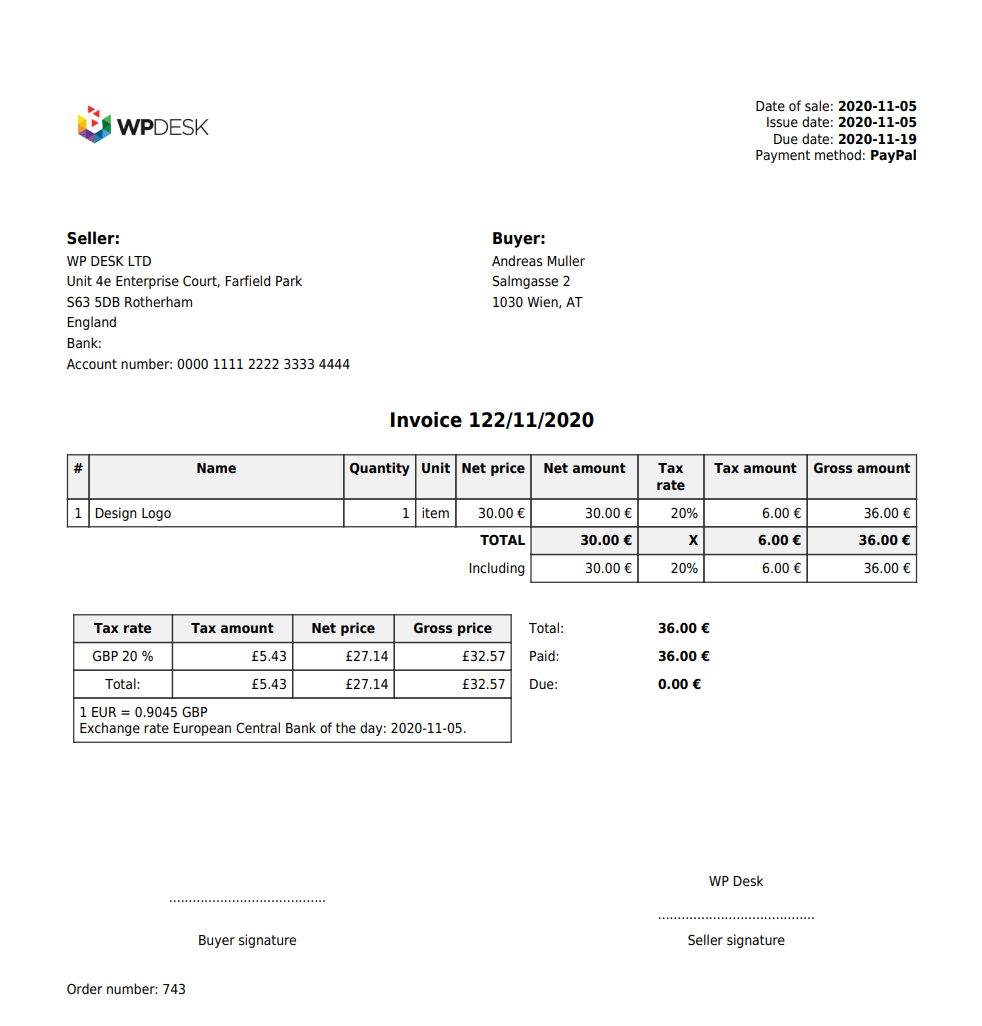

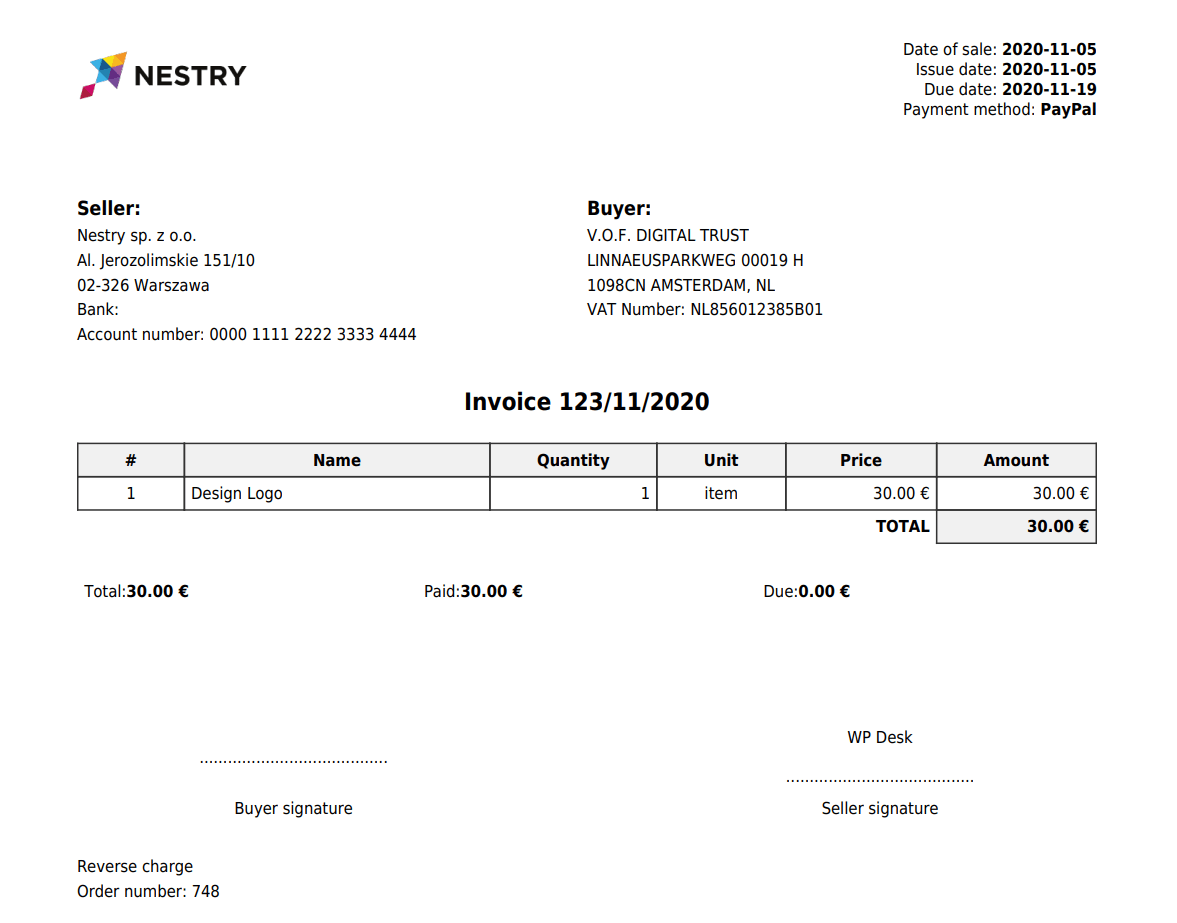

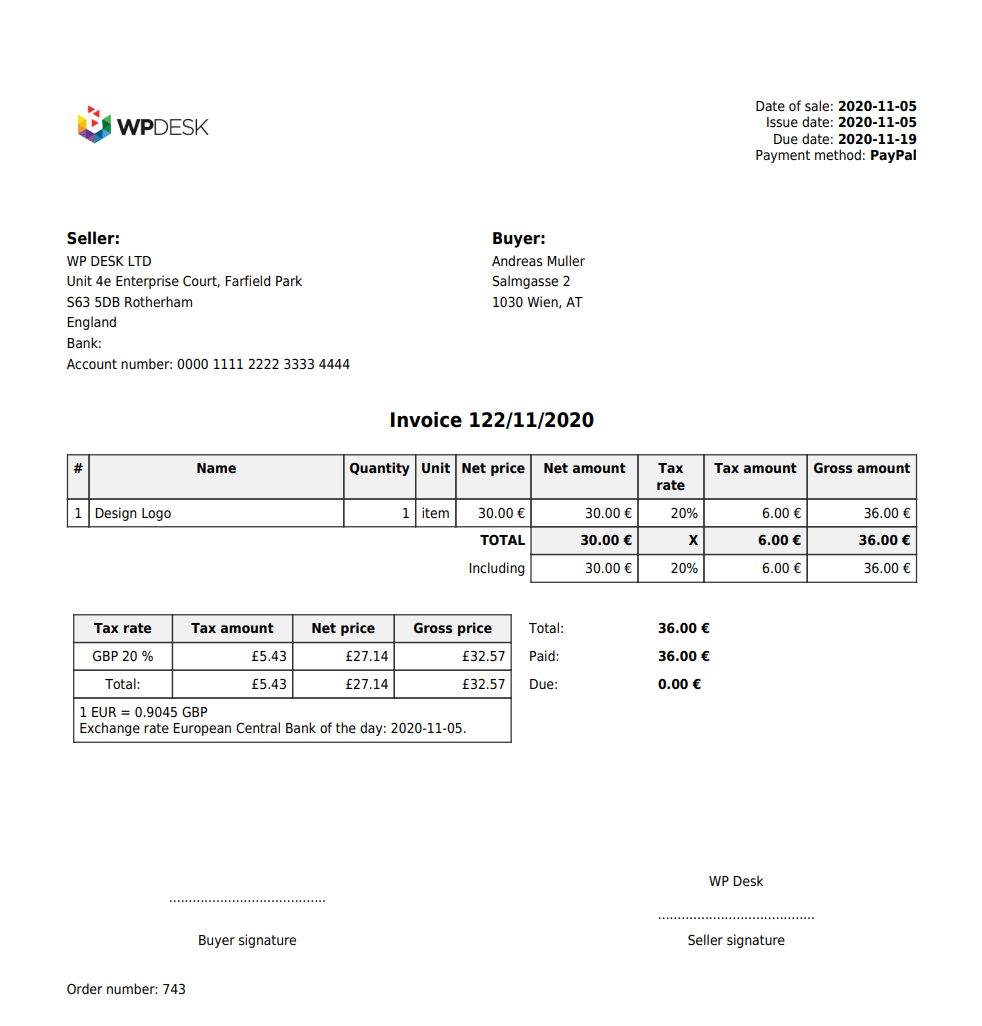

Invoicing in WooCommerce for businesses and customers from the EU – the example invoices

The plugin lets you create the WooCommerce invoice based on the type of customer automatically!

When the EU VAT number is valid, the WooCommerce invoice will get the VAT exemption:

That will meet the EU VAT compliance requirements in WooCommerce.

Reverse charge description on invoices

If you sell for business customers, the transaction will be settled using the reverse charge rule.

You need to add on an invoice the EU VAT number of your business client who declares that number when placing an order. In this case, the invoice should not include VAT though.

By default, WooCommerce does not know when to apply for VAT exemption. But it is possible with the Flexible Invoices for WooCommerce plugin setup, like in the screenshot below:

See instructions for all settings of the Flexible Invoices for WooCommerce plugin.

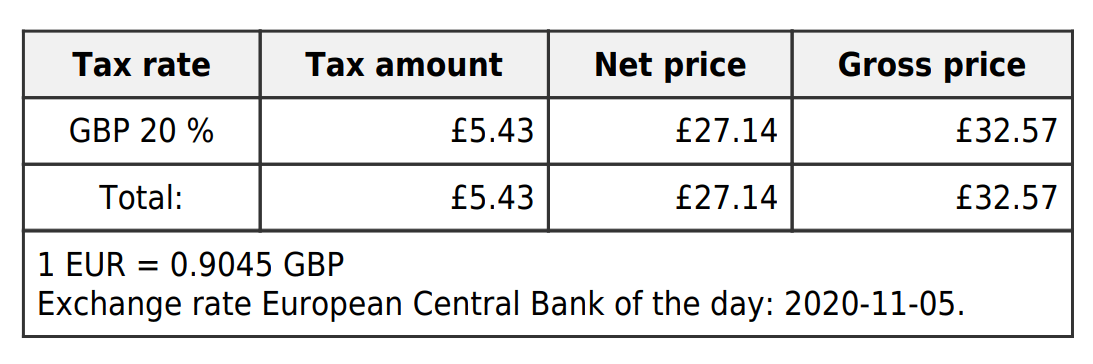

Conversion of VAT into local currency

Did you know that you need to convert VAT into your currency when issuing an invoice in another currency? With Flexible Invoices for WooCommerce, you can do that with ease.

Furthermore, the automatic download of the exchange rate from the European Central Bank will speed up the process of invoicing.

Invoices in a currency other than the WooCommerce store’s default and with specified VAT may use the new function.

It is about the conversion table on the invoice. Here’s what that kind of invoice will look like:

Exchange rates from the European Central Bank

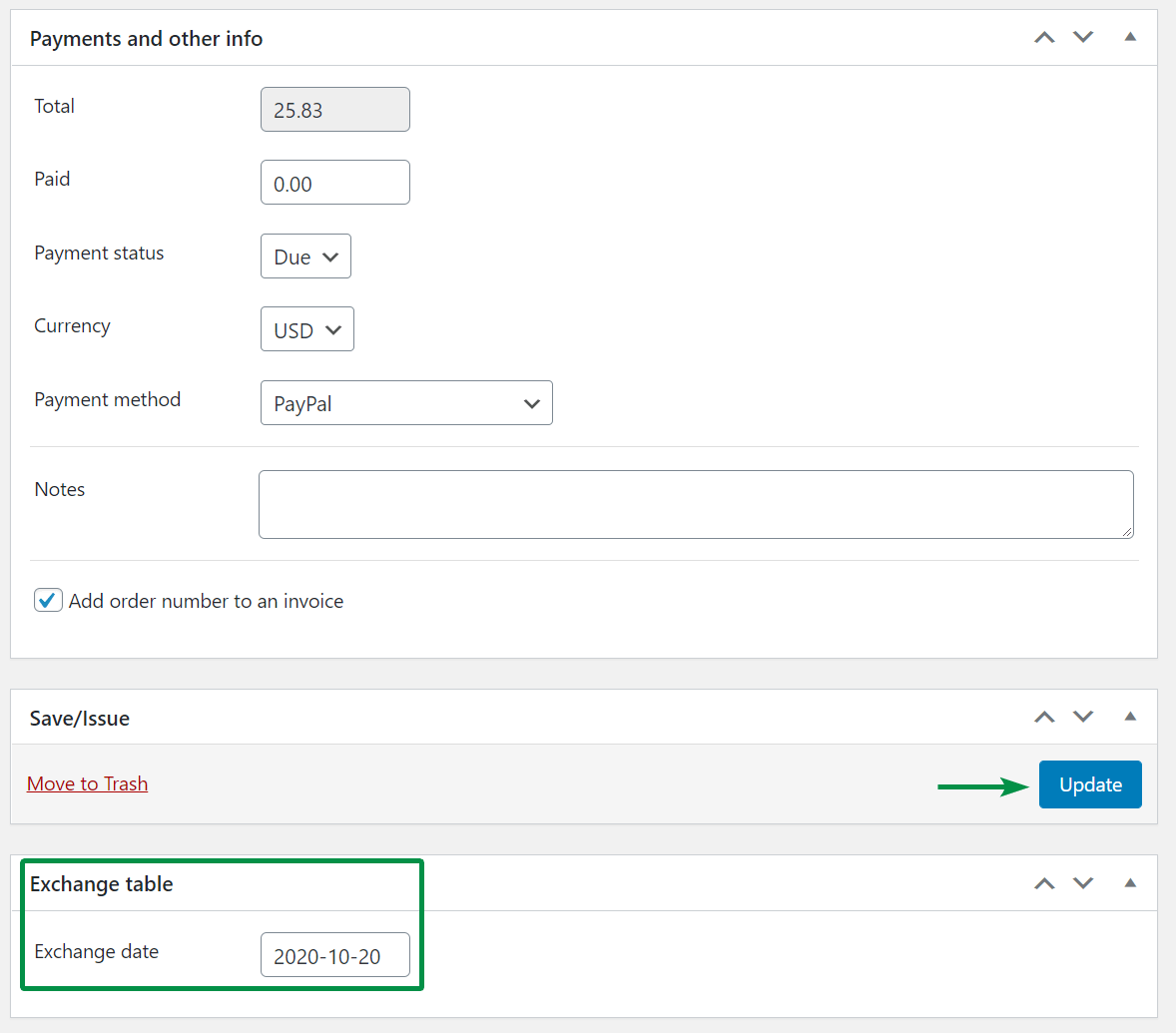

With the Flexible Invoices for WooCommerce plugin, you can enable displaying a conversion table on an invoice of VAT tax rates, net amounts, the amount of VAT, and gross amount in the main currency of the store.

What’s important, the exchange rate will be taken directly from the European Central Bank on the day preceding the sale.

Additionally, you can set a different conversion date to be used when editing an invoice directly. After saving the changes, the edited values will appear on the invoice.

Validation of the EU VAT number in the VIES database

Invoices in WooCommerce for an EU business client should also include/ add the buyer’s EU VAT number.

The Flexible Invoices plugin adds the EU VAT number field checker and validates the EU VAT number in the VIES database.

Here you can find an article about Adding the EU VAT Number Field in WooCommerce.

With Flexible Invoices for WooCommerce, the EU VAT field is added by the plugin when a client asks for an invoice at a checkout form.

When the EU VAT number is filled out at checkout, the plugin checks the given number in the European VIES system.

In the absence of an active number, it’s also possible to choose a specific further action. You can choose if the plugin shall:

- Allow the customer to place the order. VAT will not be removed from the order

- Allow the order to be placed, but remove VAT from it

- Not allow the order to be placed and display an error message:

Translations and WPML Support

You may use the plugin in English and also in French, Spanish, Italian, Polish & Dutch.

The plugin is currently translated into these languages.

WooCommerce Invoice System, facture WooCommerce, faktury WooCommerce, e-boekhouden WooCommerce?

Of course! Use it as your WooCommerce Invoice System (e-boekhouden WooCommerce) or to issue WooCommerce fakturas (or facture WooCommerce or faktury WooCommerce) in your store automatically.

You may also adjust your store to handle customers in their languages.

The Flexible Invoices plugin supports WPML!

Flexible Invoices for WooCommerce & EU VAT compliance and exemption

Running a business and online store is fascinating when you don’t have to deal with accounting matters 🙂 You shouldn’t also spend hours solving accountant issues.

Our plugin will speed up invoicing and simplify things that seem complicated. The correct setting of the plugin is easy, sometimes it is only checking one additional option.

Not to mention, getting exchange rates to the WooCommerce invoice directly from the ECB, verifying the customer’s EU VAT number in VIES, automatic VAT exemption, and OSS invoice handling.

These new features can probably save a lot of time.

Flexible Invoices – more info and support

If you want to read more about the plugin, read the article on How to create, download, email & print an invoice in WordPress & WooCommerce with a plugin. Start with the free version.

Then upgrade to PRO to have also VAT validation & OSS (MOSS) support for EU customers in one plugin!

And if you have any questions, do not hesitate to email us!

Also, read How to Configure WooCommerce Taxes a Complete Tutorial. I hope it will be useful for you.