Since July 2021, the OSS mechanism for accounting for e-sales to EU countries has been in force in tax law. Our customers are already using this mechanism, which is available in our Flexible Invoices for WooCommerce PRO plugin. In this tutorial, we will show you how to use OSS and set taxes in WooCommerce.

- About OSS mechanism

- OSS settings in Flexible PDF Invoices

- Settings for sales below 10,000 €

- Sales over 10,000 €

- Set the tax rates for OSS in WooCommerce

A few words about the OSS mechanism & WooCommerce

Do you remember what OSS is? Let me remind you! OSS is a mechanism that allows you to account for e-sales, both virtual and physical products. It applies to individual customers (B2C). In the case of the business clients (B2B), for orders placed from a country member of the EU, the tax will not be added to the order.

OSS settings in Flexible PDF Invoices for WooCommerce

The ordering party, in this case, a company from the EU, only needs to enter the EU VAT number in the appropriate field in the order form. Our plugin, Flexible PDF Invoices for WooCommerce PRO, does the rest. So if the number is correct, the tax will be removed from the order.

This is how it works if the OSS mechanism is enabled in the plugin.

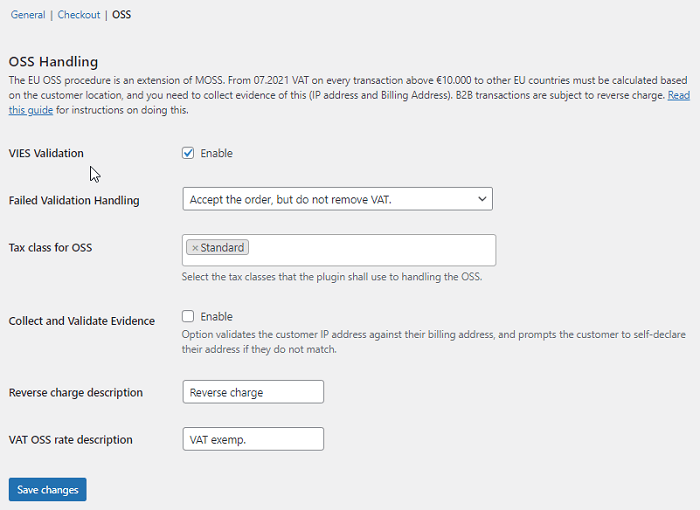

How to enable OSS in the plugin

If your store uses the Flexible Invoices for WooCommerce PRO plugin, go to Invoices → Settings → WooCommerce → OSS. This plugin has an interface with the OSS settings, including the validation of VAT EU numbers in the VIES database.

The validation is sufficient to account for orders placed in the e-store by companies from EU countries. In addition, you can choose the behavior of the plugin if the validation in the VIES database fails. You have three options to choose from:

- accept the order, but do not remove VAT

- accept the order and remove VAT

- reject the order and show the customer an error message.

It’s simple! These options will give you flexibility. This is because, in case of a negative validation, the order can either be blocked, accepted with VAT removed. It can be accepted with VAT left in place too.

Settings for sales below 10,000 €

If your international sales are below 10,000€, then I have good news – sales to individual customers from EU countries look the same as sales to orders placed in your country. Regardless of which EU country your customer comes from, the sale is taxed at your country’s VAT rate.

For a scenario up to a threshold of 10,000 euros, you need to set the tax class, which will apply regardless of the country where the order is placed from. Go to WooCommerce → Settings → Tax → Tax options and set the tax to e.g. 23%. Make sure to leave an asterisk symbol in the Country Code column.

This will mean that for orders placed from around the world for individual customers, your customer will be charged 23% tax. Check the tax rates that currently apply in your country for products and services you sell.

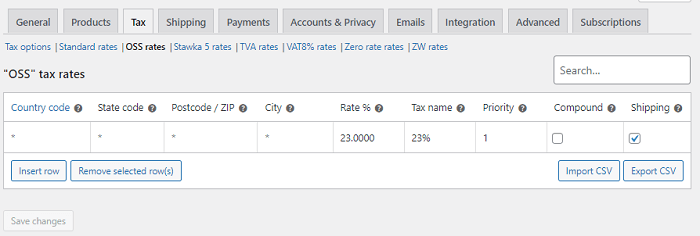

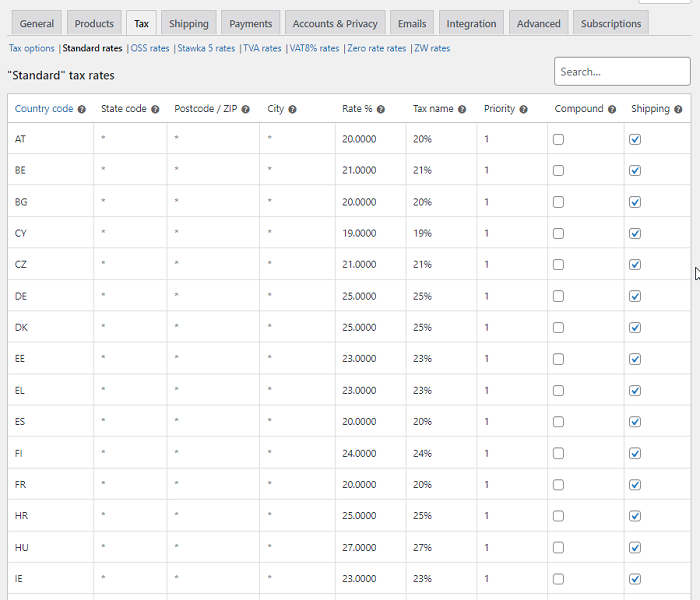

Sales over 10,000 €

This will be the case, but only until the limit of 10,000 euros for annual sales is exceeded. After exceeding the threshold, the tax for orders placed from outside your country is to be calculated at the rate of the country from which the order is placed. So an individual customer who places an order from Germany will be charged the same tax as the one applicable in Germany.

When your sales to EU countries exceed 10,000 € per year (hopefully soon!), you need to change your tax class settings. This is so that sales to EU countries take into account the VAT rates of those countries, i.e. for private customers from Austria a tax of 20% is charged.

Set the tax rates for OSS in WooCommerce

This means that for the tax class, you have to configure the taxes in WooCommerce for each EU country. In the country code field, add the codes of the EU member states one by one. Next, go to the rate field and assign the correct tax to each country.

With such a configuration, each order from France, Portugal, or the Czech Republic, will be charged the tax applicable in the given EU country. I encourage you to test the Flexible Invoices free, PRO, and its add-ons in your free demo.