On December 30, 2020, the United Kingdom left the European Union, and we adapted our WooCommerce invoice plugin to the new reality. In this article, you will learn how to create a VAT invoice to UK after Brexit in WooCommerce.

- Invoices before Brexit

- Virtual products – how to invoice them after Brexit

- Invoice for sales of goods after Brexit

- Create a VAT invoice to the UK in WooCommerce

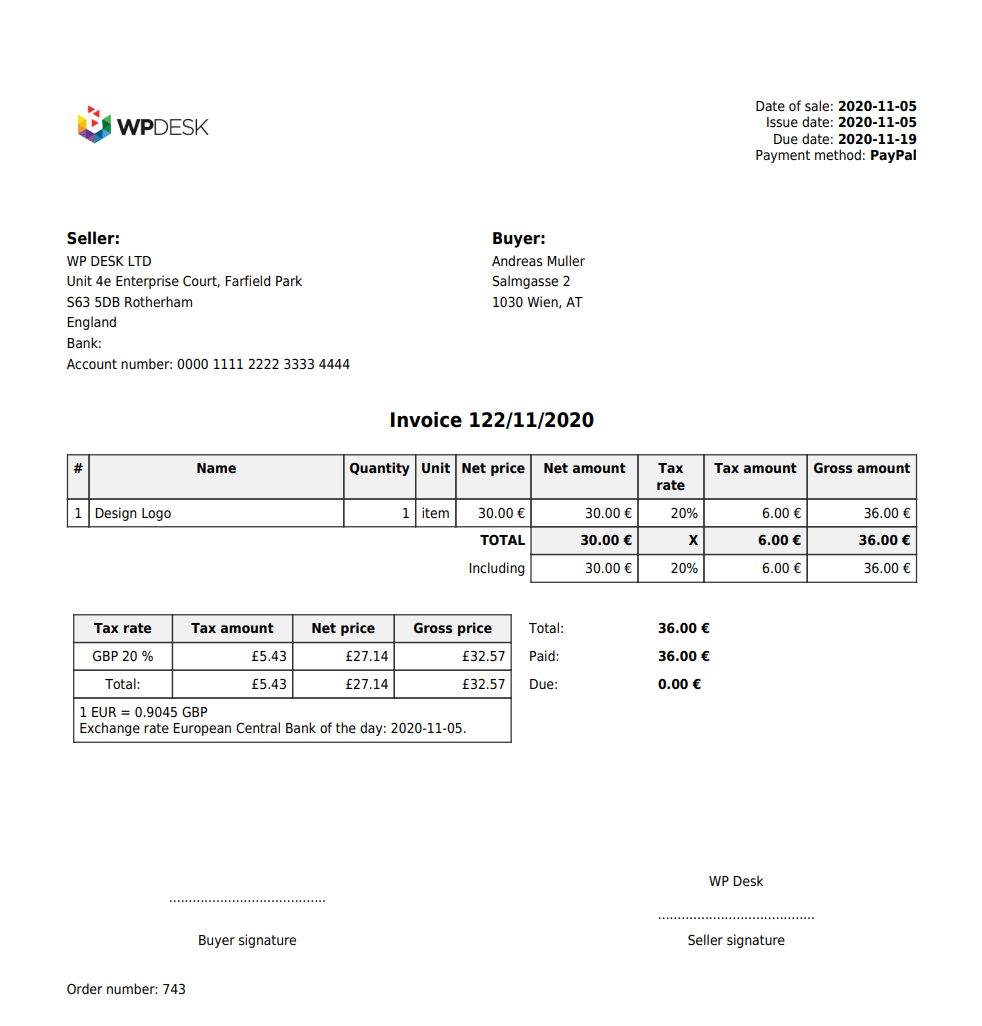

Invoices to the UK in WooCommerce before Brexit

While updating Flexible Invoices WooCommerce, we had to, understand how the invoicing procedures for the UK are changing. And decided to share the conclusions with you. But please, remember to handle this article as advice, not a rule. Be sure to consult the changes on your invoices with your accountant.

Until now European companies could use European procedures such as VAT OSS (formerly VAT MOSS) to issue invoices to the UK. You can read about it here.

From January 2021, European procedures no longer apply to UK customers. Therefore, there are some changes on invoices to UK customers, which you can read about below.

Virtual products – how to invoice to UK after Brexit?

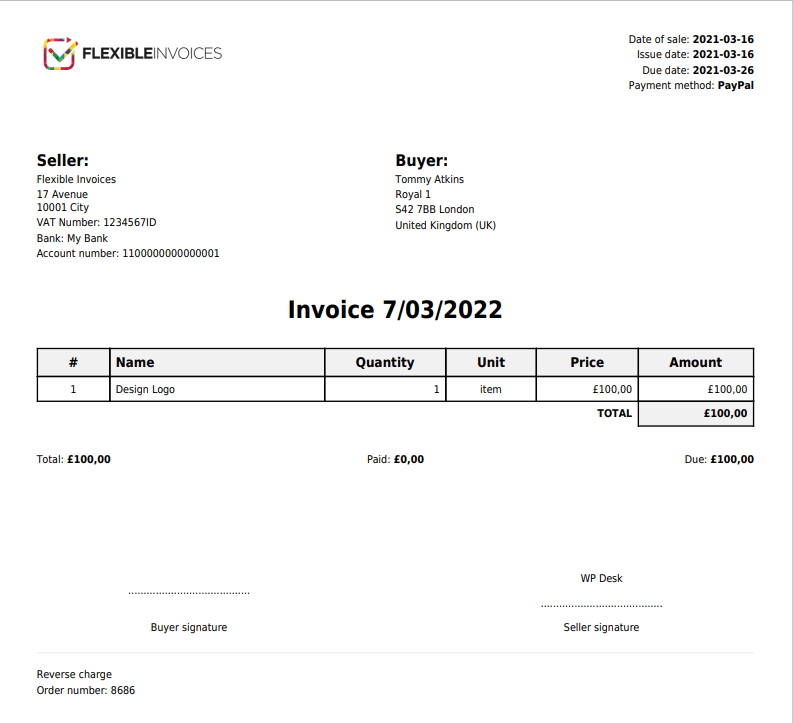

How the Brexit influenced the way you create a VAT invoice in WooCommerce? Fortunately, the changes seems to be easy.

Most important, EU companies still invoice with VAT exemption. And as before Brexit, no VAT is added to invoices.

Secondly, if the customer has a EU VAT number (what isn’t obvious in the UK), companies from EU don’t need to put it on the invoice.

Thirdly, European sellers shouldn’t omit the VAT reverse-charged note. It should still be visible on the invoice to the UK and other countries, including non-EU.

If your customer is from UK but it’s not a company, the procedure is the same unless there is a need to register for VAT in the UK. Ask your accountant if you want to know when this is necessary!

How do I invoice for sales of goods after Brexit?

The sale of goods to a UK company or individual should be treated as an export of goods outside the EU. Therefore, under one condition it will be exempt from VAT. The condition for VAT exemption will be the possession of a document confirming the export of the goods outside the EU.

How to create a VAT invoice to UK in WooCommerce after Brexit?

If you run a WooCommerce store and sell to EU or non-EU countries, check out our Flexible Invoices for WooCommerce plugin. With its help, you can easily create an VAT invoice in WooCommerce, also after Brexit!

Read some articles if you would like to know more on: